How to Build Confidence in Your CFD Trading Abilities

Navigating the intricate world of CFD trading can be daunting, especially for beginners. Building confidence in your trading abilities is crucial to making informed decisions and achieving long-term success. In this comprehensive guide, we’ll explore various strategies to help you become a more confident and successful CFD trader.

Understanding CFD Trading

CFD trading allows investors to speculate on the price movements of various financial instruments without owning the underlying asset. This includes stocks, indices, commodities, and currencies. The primary advantage of CFD trading lies in its flexibility and potential for high returns. However, it also carries significant risks, making confidence and knowledge essential for success.

The Importance of Education

Education is the foundation of confidence in CFD trading. Beginners should start with a solid understanding of the basics, including market terminology, trading strategies, and risk management techniques. Online courses, webinars, and trading books are excellent resources for gaining this knowledge. Additionally, many trading platforms offer educational materials tailored to different skill levels.

Practicing with Demo Accounts

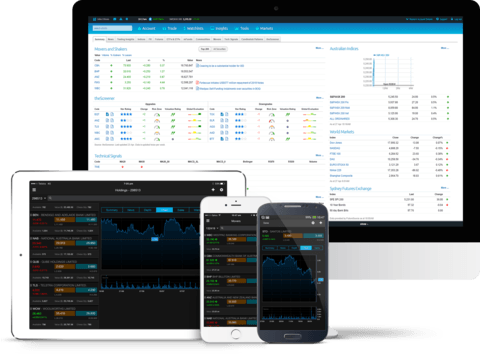

Before risking real money, practice trading with a demo account. Most CFD brokers offer these accounts, allowing you to trade with virtual funds in a simulated market environment. This hands-on experience helps you familiarize yourself with the platform, execute trades, and develop your trading strategies without the fear of losing money.

Developing a Trading Plan

A well-thought-out trading plan is crucial for building confidence. Your plan should outline your trading goals, risk tolerance, and the specific strategies you will use. Include criteria for entering and exiting trades, as well as guidelines for managing your capital. A clear plan helps you stay disciplined and reduces emotional decision-making.

Setting Realistic Goals

Setting realistic goals is essential for maintaining confidence in CFD trading. While it’s tempting to aim for substantial profits quickly, unrealistic expectations can lead to disappointment and frustration. Instead, focus on gradual progress and consistent gains. Celebrate small victories and learn from your mistakes to build a strong foundation for long-term success.

Managing Risk Effectively

Effective risk management is a key component of confident trading. Use tools such as stop-loss orders to limit potential losses and protect your capital. Diversify your trades to spread risk across different assets and markets. By managing risk effectively, you can trade with confidence, knowing that you have measures in place to protect your investments.

Analyzing Your Trades

Regularly reviewing and analyzing your trades is vital for building confidence. Keep a trading journal to record your trades, including the reasons for entering and exiting positions, and the outcomes. Analyzing your performance helps you identify patterns, strengths, and areas for improvement. This self-awareness enhances your trading skills and boosts confidence over time.

Staying Informed

Staying informed about market trends and news is crucial for confident CFD trading. Follow financial news, read market analysis reports, and keep an eye on economic indicators that impact your chosen assets. Being well-informed allows you to make educated decisions and adapt to changing market conditions with confidence.

Learning from Experts

Learning from experienced traders and industry experts can significantly boost your confidence. Join trading communities, attend seminars, and participate in online forums where you can share experiences and gain insights from others. Mentorship and networking can provide valuable guidance and support, helping you grow as a trader.

Maintaining Emotional Control

Maintaining emotional control is essential for confident trading. CFD trading can be stressful, especially during periods of high volatility. Develop techniques to manage stress and stay calm under pressure. This may include mindfulness practices, regular exercise, or simply taking breaks when needed. Emotional control allows you to make rational decisions and trade with confidence.

Utilizing Trading Tools

Take advantage of the various trading tools available to enhance your confidence. These include technical analysis tools, charting software, and trading signals. These tools can help you identify trends, make informed decisions, and execute trades more effectively. Familiarize yourself with these tools and incorporate them into your trading strategy.

Staying Persistent and Patient

Building confidence in CFD trading is a gradual process that requires persistence and patience. Understand that success won’t come overnight, and setbacks are part of the learning curve. Stay committed to your trading plan, continuously educate yourself, and remain patient. Over time, your confidence will grow, leading to more successful trading outcomes.

Conclusion

Building confidence in your CFD trading abilities is a crucial step toward achieving success in the financial markets. By educating yourself, practicing with demo accounts, developing a trading plan, and managing risk effectively, you can trade with confidence and make informed decisions. Stay persistent, learn from your experiences, and utilize available resources to enhance your trading skills. Remember, confidence in trading is not about being fearless; it’s about being prepared, informed, and resilient. Happy trading!